Residual Income Model Valuation

The Residual Income (RI) valuation method is another robust technique for estimating a company’s intrinsic value, particularly useful for firms that do not distribute dividends or have irregular dividend patterns. Unlike traditional dividend-based models, the residual income approach focuses on the profits that remain after accounting for the cost of capital. This makes it valuable for firms where dividends do not accurately reflect profitability or where earnings are more reliable than dividend payments.

Residual income represents the net income generated by the company above the required return on its equity. It is calculated as the company’s earnings minus a charge for the cost of equity capital. We can estimate the firm’s total value by adding the present value of future residual incomes to the current book value of equity. This model is particularly useful for valuing companies that may have volatile earnings but consistently generate returns above their cost of capital. It is often employed when companies have positive earnings but might not pay dividends, providing a more comprehensive measure of shareholder value.

Watch My Video on RIM Valuation

If you’re new to RIM or need a deeper dive into the calculation process, I have created a detailed YouTube video explaining how to value a company using the RIM valuation method. In this video, I walk through the steps of calculating Residual Income, estimating growth rates, and using the two-stage growth model to find a firm’s intrinsic value. After watching the video, you’ll have a clear understanding of how to apply this method in practice. Be sure to download the accompanying Excel template to follow along with the valuation process.

RIM Valuation Process

The Residual Income Model (RIM) valuation process involves estimating a company’s value by focusing on the residual income it generates. Residual income refers to the profits that remain after deducting the cost of equity from the company’s net income. This method measures the excess return generated by a firm over its required rate of return on equity. Here’s a step-by-step explanation of the RIM valuation process:

Key Steps of RIM Valuation

- Calculate Book Value of Equity: Start by determining the company’s current book value of equity, which is the value of its assets minus its liabilities, as listed on the balance sheet. This book value serves as a baseline for the valuation process.

- Calculate Residual Income: Residual income (RIt) for each forecasted year is calculated as Net Income minus the equity charge (re x Book Value of Equity t-1).

- Discounted Residual Income: Each year’s residual income is then discounted to its present value using the cost of equity. The formula is: PV (RIt) = RIt divided by (1+re)t.

- Determine the Terminal Value: Once the forecast period is over, the terminal value of residual income is calculated. This terminal value represents the company’s residual income beyond the forecast period, usually based on a long-term growth assumption. The terminal value is discounted to the present as well: TV=RIt+1 divided by (re-g).

- Add Book Value and Present Value of Residual Income: Finally, the intrinsic value of the firm’s equity is estimated by summing two components: (a) The company’s current book value of equity (b) The present value of all future residual incomes, including the terminal value.

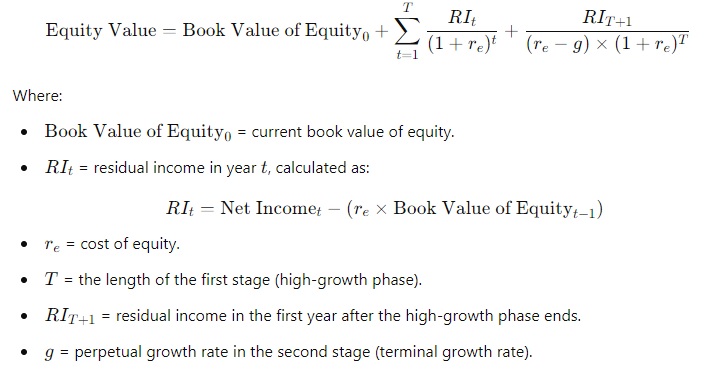

The Two-Stage Growth Formulas for RIM

In the Residual Income Model (RIM), the valuation of a company can be approached with either a single-stage or a two-stage growth assumption, depending on whether we expect a constant growth rate or changing growth rates over time.

- Single-Stage Growth: The single-stage RIM assumes that the firm’s residual income grows at a constant rate indefinitely.

- Two-Stage Growth: The two-stage RIM assumes two phases of growth: (a) a first phase where residual income grows at a higher (or different) rate for a specified number of years (b) A second phase where residual income grows at a constant, long-term rate.

The value of the equity using the two-stage growth model is calculated using the following formula:

Download the RIM Valuation Excel Template

To simplify your RIM valuation process, I have created a custom-designed Excel template incorporating the two-stage growth model. This template allows you to input financial data and assumptions, automatically calculating the intrinsic value of any public company.

How to Use the Template:

- The template includes four sheets: one for RIM valuation, one for historical financial ratios, one for analyst estimates, and one for market data.

- Enter your assumptions in the yellow-highlighted cells, and the template will compute the firm’s intrinsic value based on the two-stage growth model.

- You can pull financial information from sources like Morningstar and Yahoo Finance, which are free and easily accessible.

- For any issues while working on the template, such as incorrect data inputs, download a fresh copy and start all over again.

This template is designed to simplify the RIM valuation process while providing flexibility for assumptions on growth rates, expected ROE, and other key variables. It’s a practical tool for investors, students, or professionals who want to estimate the intrinsic value of companies using a robust valuation technique.

Click below to download the Excel template and start your valuation process:

[Download RIM Valuation Excel Template]

[Download RIM Valuation Sample File on CVS Health Corporation]

| RIM Model: Company Valuation using Residual Income (RIM) |

| ▸ Excel Template File |

| ▸ Valuation Sample File |

| Other Topics |

| ▸ DCF Model – FCFF |

| Free Courses: |

|