Discounted Cash Flow Model- FCFF Valuation

The Free Cash Flow to the Firm (FCFF) valuation method is one of the most widely used techniques for estimating a company’s intrinsic value. It calculates the value of a firm by discounting its expected future free cash flows to the present. Unlike dividend-based models, the FCFF approach works even for companies that do not pay dividends or whose dividend policies are not aligned with their earnings. This method is useful for valuing firms with consistent positive cash flows and for cases where dividends do not fully reflect the firm’s profitability.

FCFF represents the cash flow available to the firm’s stakeholders (both debt and equity holders) after accounting for capital expenditures, taxes, and working capital. By discounting future FCFF at the company’s Weighted Average Cost of Capital (WACC), we can estimate the total value of the firm, from which the value of equity can be derived.

Watch My Video on FCFF Valuation

If you’re new to FCFF or need a deeper dive into the calculation process, I have created a detailed YouTube video explaining how to value a company using the FCFF method. In this video, I walk through the steps of calculating FCFF, estimating growth rates, and using the two-stage growth model to find a firm’s intrinsic value. After watching the video, you’ll have a clear understanding of how to apply this method in practice. Be sure to download the accompanying Excel template to follow along with the valuation process.

FCFF Valuation Process

The FCFF valuation model involves projecting the firm’s future free cash flows and discounting them back to their present value using the company’s Weighted Average Cost of Capital (WACC). This approach allows for a comprehensive assessment of the company’s value, accounting for the firm’s capital structure, risk profile, and future growth prospects.

Key Components of FCFF Valuation

- Free Cash Flow (FCF): The amount of cash generated by the company after accounting for capital expenditures and changes in working capital. FCF can be derived from the company’s financial statements (income statement, balance sheet, and cash flow statement).

- Weighted Average Cost of Capital (WACC): The company’s overall cost of capital, including both debt and equity. It serves as the discount rate in the FCFF model, reflecting the risk associated with the firm’s cash flows.

- Growth Assumptions: Companies typically experience different stages of growth. The FCFF model can be adapted to account for stable growth, high growth followed by stable growth (two-stage model), or even more complex scenarios with multiple stages of growth (three-stage model).

The Two-Stage Growth Model for FCFF Valuation

The two-stage growth model is particularly useful when valuing companies that are expected to experience high growth initially, followed by a period of stable growth. This method divides the company’s growth trajectory into two distinct phases:

- High-Growth Stage: The company’s free cash flows (FCFF) are expected to grow rapidly for a specific number of years. These cash flows are projected year by year and discounted to the present using the firm’s WACC.

- Stable-Growth Stage: After the high-growth phase, the company is assumed to enter a stable growth period, where its free cash flow grows at a constant, typically lower, rate indefinitely.

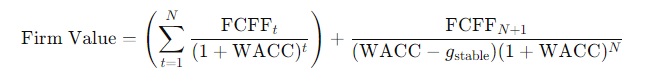

The value of the firm using the two-stage growth model is calculated using the following formula:

Where:

- FCFFt = Free cash flow in year t during the high-growth phase.

- N = Number of years in the high-growth phase.

- WACC = Weighted Average Cost of Capital.

- gstable = Long-term stable growth rate of FCFF.

- FCFFN+1 = Free cash flow at the start of the stable growth period.

Download the FCFF Valuation Excel Template

To make your FCFF valuation process easier, we have created a custom-designed Excel template that incorporates the two-stage growth model. This template allows you to input financial data and assumptions, automatically calculating the intrinsic value of any public company.

How to Use the Template:

- The template includes four sheets: one for FCFF valuation, one for historical financials, one for analyst estimates, and one for market data.

- Enter your assumptions in the yellow-highlighted cells, and the template will compute the firm’s intrinsic value based on the two-stage growth model.

- You can pull financial information from sources like Morningstar and Yahoo Finance, which are free and easily accessible.

- For any issues while working on the template, such as incorrect data inputs, simply download a fresh copy and start again.

This template is designed to simplify the FCFF valuation process while providing flexibility for assumptions on growth rates, WACC, and other key variables. It’s a practical tool for investors, students, or professionals who want to estimate the intrinsic value of companies using a robust valuation technique.

Click below to download the Excel template and start your valuation process:

[Download FCFF Valuation Excel Template]

[Download FCFF Valuation Sample File on CVS Health Corporation]

| DCF Model: Company Valuation using Free Cash Flow (FCFF) |

| ▸ Excel Template File |

| ▸ Valuation Sample File |

| Other Topics |

| ▸ RIM valuation model |

| Free Courses: |

|